Black-owned businesses have become a vital and essential component of the American economy.

A recent survey report by the National Black Chamber of Commerce reveals that there are over 2.6 million Black-owned businesses in the United States that employ around 1 million people and generate over $150 billion in annual revenue.

However, Black-owned businesses encounter significant hurdles in accessing the funding and resources necessary for their growth and success.

Another survey report by the Federal Reserve indicates that only 66.4% of BIPOC (Black, indigenous, or person of color) business owners receive at least a percentage of the funding they request from a bank, compared to 80.2% of white business owners. The statistics highlight the disparity in the ease of access to financing for black-owned businesses.

To help black entrepreneurs overcome these challenges, many organizations have come forward to boost funding opportunities for black-owned businesses through grants.

| What is a grant? Grants are generally financial awards specifically designed to support and empower entrepreneurs and help them grow their businesses. These grants are typically non-repayable and provided by government agencies, private foundations, and other organizations. |

Business grants can provide black business owners with valuable capital to invest in new equipment, hire additional employees, and expand their operations. By utilizing grants that especially support black-owned businesses, the owners can overcome financial barriers and achieve their goals.

In this blog, we will:

- Explore the different grant programs provided by the government and private institutions.

- Cover key grant application factors to consider.

Top grant options to boost your black-owned business

Listed below are some of the grant options that black business owners and other minority businesses can consider:

1. Fast Break for Small Business

The Fast Break for Small Business is a program started by LegalZoom in association with the National Basketball Association (NBA), Women’s National Basketball Association (WNBA), NBA G League, and Accion Opportunity Fund, to support Black-owned small businesses. This $6 million initiative includes grants and LegalZoom services to aid black-owned business enterprises across the country.

Benefits of the grant

According to the scheme:

- 100 grants of $10,000 each are awarded in two rounds in 2023 (Invitation to the first round concluded recently).

- In each cycle, 50 black-owned businesses will get $10,000 grants and a free LegalZoom product (valued up to $500).

- 1,950 small businesses will also get free LegalZoom products (valued up to $500).

- Invitation for the second cycle will take place later in the year.

Eligibility criteria

To be eligible, a black-owned business must meet the following requirements:

- Business should be based in the United States.

- It should be black-owned.

- The business should have been operational for at least six months (since August 1, 2022) and is currently in operation.

- If the business is 6 to12 months old, it should have one of the following:

- Articles of incorporation for LLCs, S Corps, and C Corps

- Sole proprietorship formation

- Fictitious name statement or DBA

- EIN registration

- City, state, or federal license to do business

- Relevant professional license

- If the business is 6 to 12 months old but does not have any of these documents, the business is not eligible for this grant.

- Business should have annual revenue of less than $1 million.

- Have a business bank account.

- Not be in an industry that has been identified as a prohibited industry for this program.

When to apply?

The third edition was recently concluded. The next grant cycle will be open later during the year.

Where to apply?

To submit for the next grant cycle, please visit the Fast Break for Small Business’ application page.

2. Grants.gov

Grants.gov is a centralized platform for searching and applying for federal government grants. It is maintained by the Office of Management and Budget (OMB) and provides information about over 1,000 federal grants across various federal government agencies, including the U.S. Department of Commerce and the U.S. Small Business Administration. The platform allows users to search for grant opportunities that align with their business goals and apply for them directly through the Grants.gov system.

Benefits of Grants.gov

Grants.gov offers a variety of benefits for Black-owned small businesses seeking funding opportunities. Here are the key benefits:

- Access to a wide range of grant opportunities: Grants.gov provides a centralized location to search and apply for federal grant opportunities. This can be a valuable resource for Black-owned small businesses that may not have access to other sources of funding.

- Streamlined application process: It provides a streamlined application process that makes it easier for small businesses to apply for funding. The system allows applicants to complete and submit grant applications online, which can save time and reduce administrative burdens.

- Support for grant management: The platform also provides resources and tools to help small businesses manage their grants once they have been awarded. This can help ensure that funds are used appropriately.

Eligibility criteria

For the application process in Grants.gov, the applicants:

- Must have a unique entity ID, which is necessary to bid on government contracts and apply for federal grants.

- Need to create a workspace account on Grants.gov. This account will allow you and your team to access the system’s applications and apply for grants that align with your business goals.

- Can be government organizations, education organizations, public housing organizations, nonprofit organizations, for-profit organizations, small businesses, and individuals. For each applicant type, eligibility requirements differ.

Note: Some grant programs may have age restrictions for individual applicants.

When to apply?

There are a number of grant programs available on the site and for each program, the submission varies. Keep checking the date of submission for the grant of your choice.

Where to apply?

To submit a grant application, please visit Grants.gov page.

3. Coalition to Back Black Businesses

The Coalition to Back Black Businesses is an alliance of major brands with the aim of empowering Black-owned businesses. The Coalition consists of American Express, ADP, AIG Foundation, Altice USA, Dow, and the S&P Global Foundation. The goal of the Coalition is to provide $14 million in grants, resources, and training to minority-owned small businesses that have been impacted by the COVID-19 pandemic.

Benefits of the grant

- The selected black-owned small business will receive an amount of $5,000.

- Grantees will also have the option to compete for $25,000 enhancement grants based on additional criteria.

Eligibility criteria

To be eligible for the grant, the applicant must meet the following requirements:

- Be a Black-owned small business, with the owner having 51% or more ownership in the business.

- Have between 3 and 20 employees, including the owner, full-time employees, part-time employees, or individuals working under a 1099 or similar contractual agreement.

- Not be part of a franchise brand with more than 25 corporate-owned stores or more than 250 stores in total.

- Be located in an economically vulnerable community

- Have been financially affected by the COVID-19 pandemic.

When to apply?

This year’s grant application process starts on August 22 and ends on September 6. Black-owned businesses can first express their interest to participate in the small business grants scheme. If shortlisted, then, the applicants would be asked to fill out a complete grant application form.

Where to apply?

To submit a grant application, please visit Coalition to Back Black Businesses’ website.

4. The National Black MBA Association Scale-Up Pitch Challenge with Collegiate Edition

The National Black MBA Association (NBMBAA) has created a business grant contest called the Scale-Up Pitch Challenge. The contest aims to give eligible Black-owned startups the chance to connect with early-stage investors and venture capitalists. Under this, the businesses get a chance to pitch their ideas to a panel of judges.

Benefits of the grant

- The top three finalists will receive cash prizes of $50,000, $10,000, and $7,500, respectively.

- In addition to the first three prizes, the audience also has the opportunity to vote for the People’s Choice Award. The winner will receive a cash prize of $1,000.

Eligibility Criteria

To be eligible for the NBMBAA Scale-Up Pitch Challenge, applicants must meet the following criteria:

- Be a member of the NBMBAA.

- Be a founder, co-founder, or CEO of a scalable, innovative business that is less than five years old.

- The business must be headquartered in the United States, with majority ownership (51% or more) held by an African American.

- Ideas and concepts pitched must be in the initial or early stages of development.

- Have an existing customer base or demonstrated market interest in the product.

- Have a business model with the potential for significant growth and expansion.

- Be able to commit to attending the pitch competition, which is typically held in the fall.

When to apply?

The application period for the NBMBAA Scale-Up Pitch Challenge typically opens in the summer, with a deadline in early fall. The specific dates may vary from year to year. Interested applicants should check the NBMBAA website for the most up-to-date information. The final event for this year will be held on September 15, at NBMBAA annual conference in Pennsylvania.

Where to apply?

To submit a grant application, please visit the Scale-Up Pitch Challenge page.

5. Backing the B.A.R

The National Association for the Advancement of Colored People (NAACP) and Bacardi have joined forces to support Black-owned businesses in the hospitality industry. They are providing over $350,000 in acceleration grants, education, support, and entrepreneurship solutions through their Backing the B.A.R grants. This grant is designed to provide financial assistance to help business owners grow and reach their full potential.

Benefits of the grant

- Dedicated support for Black-owned businesses in the beverage alcohol service, sales, and hospitality industries.

- Grants of $10,000 to grantees to support their businesses.

- Mentorship support.

- Assistance for businesses in the process of applying for a liquor license.

Eligibility criteria

To be eligible for the Backing the B.A.R grants:

- The applicant must be a Black business owner with a liquor license or who is in the process of obtaining one.

- The business must operate in the beverage-alcohol service, sales, or hospitality industry and be in need of financial, educational, or mentorship support.

When to apply?

Interested businesses can apply for this year’s Backing the B.A.R grants from June 17. The last date to apply is July 30, so be sure to apply during that time if you are eligible.

Where to apply?

To submit a grant application, please visit Backing the B.A.R. page.

6. Operation HOPE 1 Million Black businesses

The Operation HOPE program is a unique initiative aimed at supporting people of color and aspiring entrepreneurs by providing them with business training, financial counseling, and access to small-business financing options. Through a partnership with Shopify, the program offers free access to Intuit and Shopify products, along with coaching.

Benefits of the grant

- Small business owners can sign up for business courses.

- It assists you to connect with a mentor.

- Grant recipients get access to education and coaching services.

Eligibility criteria

To participate in the Operation HOPE program, there are no specific eligibility criteria. However, it is recommended that each participant invest time to understand their unique needs, gather information and tools, and develop a plan of action to achieve their goals.

The program is free of charge and tailored to meet the specific needs of each entrepreneur or business owner. No prior business or financial knowledge is required. The program is open not just to minority-owned businesses, but to anyone who is interested in starting or growing a business.

When to apply?

Operation HOPE’s 1 Million Black Business Initiative is an ongoing effort to empower and uplift Black entrepreneurs and business owners.

Where to apply?

To submit a grant application, please visit the Operation HOPE website. On the homepage, scroll down and click on the “1MBB” tab, which will provide information about the program and a link to the application.

7. Wish Local Empowerment Program

Wish Local is an e-commerce platform that provides physical pick-ups and delivery of online purchases. The company has created a $2 million fund to issue Wish Local Empowerment grants to Black-owned, brick-and-mortar small businesses that are Wish Local partners.

The Wish Local Empowerment grants are aimed at promoting equality and diversity in American businesses. They support minority-owned businesses that have long faced hardship due to systemic racism.

Benefits of the grant

- Selected recipients will get grant amounts ranging from $500 – $2,000.

- These small business grants for minority-owned businesses are flexible in their use of funds.

- Around 4,000 Wish Local minority business enterprises will be benefitted.

Eligibility criteria

To be eligible for the Wish Local Empowerment grants, the following criteria must be met:

- The business must be Black-owned.

- The business owner must be 18 years or older.

- The store must have 20 or fewer employees.

- The store must be a brick-and-mortar shop located within the United States.

- The store must have an average annual revenue of less than $1 million.

- If selected for the program, the business must join Wish Local.

When to apply?

Applications are currently being accepted, and interested parties can apply soon. There is no information provided on the application deadline. Please check the Wish Local Empowerment page to know more.

Where to apply?

To submit a grant application, please visit the Wish Local Empowerment program’s website.

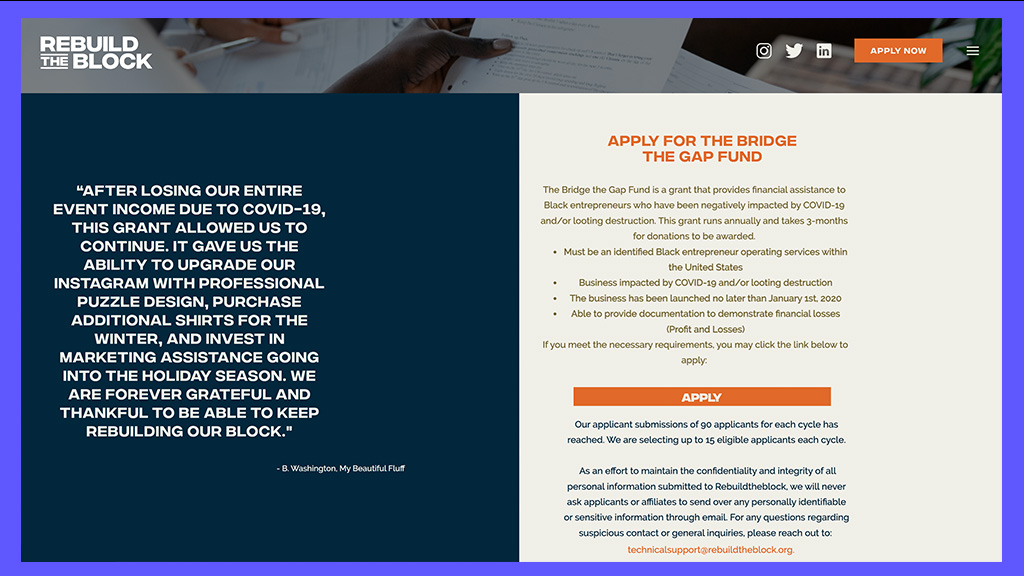

8. Rebuildtheblock-Bridge the Gap Fund

The ‘Bridge the Gap’ fund is designed to create funding opportunities for Black business owners who have been adversely affected by COVID-19 and/or looted destruction.

Benefits of the grant

- The applicants can register for the grant throughout the year.

- Up to 90 applicants can apply during each three-month application period. From these 90, 15 applicants will be rewarded.

Eligibility Criteria

To be eligible for the Bridge the Gap Fund, applicants must meet the following criteria:

- The business should be black-owned and have operations in the United States.

- The business must have been impacted by COVID-19 and/or looting destruction.

- The business must have been launched no later than January 1st, 2020.

- They should be able to provide documentation to demonstrate financial losses (Profit and Losses).

When to apply?

For the current cycle, the application submission has reached the limit. Look out for the next grant cycle to open.

Where to apply?

To submit a grant application, please visit Rebuildtheblock-Bridge the Gap Fund page.

9. Black Founder Startup Grant

The SoGal Foundation has come together with several sponsors to provide Black women and non-binary entrepreneurs with a small step towards success by offering $5,000 and a maximum grant amount of $10,000. The goal is to help Black entrepreneurs who have faced systemic discrimination and barriers in accessing capital to grow their businesses. The awardees will also receive tactical help in navigating the fundraising environment and lifetime access to the SoGal Foundation and SoGal Ventures teams.

Benefits of the grant

- Financial support to Black women founders and entrepreneurs.

- Grant amounts of $5,000 and $10,000 for selected recipients.

Eligibility criteria

To be eligible for the Black Founder Startup grants, applicants must:

- Self-identify as a Black woman or Black non-binary entrepreneur, inclusive of multiracial Black women and multiracial Black non-binary individuals.

- Have a legally registered business.

- Plan to seek investor financing in order to scale their business, now or in the future.

- Have a scalable, high-impact solution or idea with the ambition to become the next billion-dollar business.

When to apply?

SoGal Foundation’s grant program is open and entrepreneurs can apply now. There is no information provided on the application deadline. Please check their website page for details.

Where to apply?

To submit a grant application, please visit the Black Founder Startup Grants page. The grants will be awarded on a rolling basis.

10. FedEx Small Business Grant Contest

FedEx launched the Small Business Grant Contest in 2012 as a grant program to recognize and award small businesses in the United States with grants to help improve their businesses.

Benefits of the grant contest

- 10 winners will receive a grand prize of $30,000 each in the form of a check.

- Each grand prize winner will also receive a $1,000 print credit at FedEx Office.

- One of the 10 winners (must be a Veteran-owned business), will receive an additional $20,000 courtesy of USAA Small Business Insurance.

- Other prizes include access to:

- FedEx’s premier customer service

- Sustainable Packaging Consultation with FedEx Packaging Lab

- Complimentary digital technology consultation with the FedEx Digital Sales Solutions team

- 20% off on SEO Monthly Plan with HigherVisibility

- Mentor matching with Entrepreneurs’ Organization, and much more

Eligibility criteria

To be eligible for the FedEx Small Business Grant Contest:

- A business must be for-profit and have a FedEx business account number.

- It must have been in continuous operation for at least six (6) months selling a product or service in the market by the time the contest starts.

- It should have fewer than 99 employees, with owners and part-time employees considered as employees.

Learn more about the contest rules here.

When to apply?

The entries to apply for this year’s contest recently got closed.

Where to apply?

To apply for the next contest cycle, please visit the FedEx Small Business Grant Contest page.

11. Kinetic Black Business Support Fund

The Kinetic Black Business Support Fund is a grant program offered by Arkansas-based Kinetic Business, a fiber internet company by Windstream, to support Black-owned small businesses in their service area.

Benefits of the grant

- The program provides up to $2,500 in grants to minority small business owners

- Free business internet

- Free business consultations

Funds are awarded on a first-come, first-served basis, and submitting an application does not guarantee a grant award or an award of any particular amount.

Eligibility criteria

To participate in the Kinetic Black Business Support Fund program, a business must meet the following requirements:

- Be a new or current small business customer within the service area of Windstream.

- Be black-owned and have 25 or fewer employees.

- Not be engaged in bankruptcy proceedings.

- Shouldn’t be a non-profit organization, or in the wine & spirits business, check-cashing agency, gun shop, pawn shop, or adult entertainment industry.

Businesses that are awarded a grant must maintain compliance with the eligibility criteria during the 12-month grant term. They must also provide all required documentation upon request by Windstream for eligibility confirmation.

When to apply?

Applications are currently being accepted, so interested small business owners should apply as soon as possible to be considered for the program.

Where to apply?

To submit a grant application, please make a call at (866) 445-5930.

12. Oakland Black Business Fund

The Oakland Black Business Fund (OBBF), a non-profit organization in collaboration with Community Bank of the Bay and Alliance for Community Development, provides grants for Black-owned businesses in Oakland, California. The program operates on the principle of building relationships between Black businesses and Black technical assistance providers.

Benefits of the grant

- The program aims to provide financial capital, technical assistance, and other business development programs to minority business owners.

- Funding for Oakland-based Black businesses.

Eligibility criteria

The online application process is short and straightforward, with a focus on making it accessible to as many eligible businesses as possible. The granted amounts are not publicly available on the OBBF website.

The low barrier to entry, high acceptance approach to accessing capital, and focus on building relationships between Black businesses, make it an ideal program for eligible businesses in the area.

When to apply?

Applications are currently being accepted. There is no information provided on the application deadline. Please check the OBBF page to know more.

Where to apply?

To submit a grant application, please visit the Oakland Black Business Fund application page.

| Disclaimer: The information provided in this blog about grants for black-owned businesses is for informational purposes only. We sourced it from grants websites and company pages providing grants. We cannot guarantee the accuracy or availability of any of the grants listed, as companies and grant programs frequently update their information. Please research each grant and its requirements before applying. |

Essential factors to consider when applying for a business grant

When looking for grant funding, it is essential to carefully consider several key factors to increase the businesses’ chances of success. Here are some of the important elements to keep in mind:

1. Eligibility requirements

When applying for small business grants or minority grants, it’s important to check if the project or business is eligible. Every grant has its own rules, and not following them could lead to an application rejection. It’s essential to understand the funding criteria and make sure the project or business matches the grant’s objectives. Researching the eligibility criteria is crucial to improve the chances of a successful grant application.

2. Purpose and alignment with the grant program

To apply for a grant, organizations should clearly state their project’s purpose and its alignment with the grant program’s goals. They should understand the grant program’s specific priorities and make sure their project fits within them. A well-articulated purpose can substantially increase the chances of their grant application being accepted by the minority business development agency or the grant program.

3. Budget and financial planning

When applying for a grant, having a well-prepared budget is crucial. The applicant should understand their finances and create a budget that shows all costs and expected income. A strong budget demonstrates that the organization can manage funds and reach its goals, which boosts its chances of getting the grant.

4. Letters of support

A few letters of support from partners, stakeholders, or community members can provide additional credibility to the grant application. These letters demonstrate the level of support for the project or organization and provide third-party endorsements. This further adds up to the success of the project.

5. Networking and resources

Networking and finding the right resources can also play a crucial role in obtaining funding. Connect with successful business owners or organizations that have received small business grants in the past. Seek assistance from a grant writer or consultant to enhance the application’s quality.

| Important note: This list includes the critical factors to consider when applying for a business grant. There may be additional factors that businesses should consider when applying for a grant that might not be included here. It is advisable for businesses to do their research and seek professional advice before applying for a grant. |

Wrap up

The growth grant programs can provide much-needed support for black-owned businesses. Ultimately, it’s important to keep in mind that the competition for grant funding can be intense. By following these guidelines and seeking out the right resources, black-owned small businesses can maximize their chances of securing grant funding to support their goals and help their organizations thrive.